Bitcoin Topples Saudi Aramco To Become World's 7th Largest Asset By Market Cap

KEY POINTS

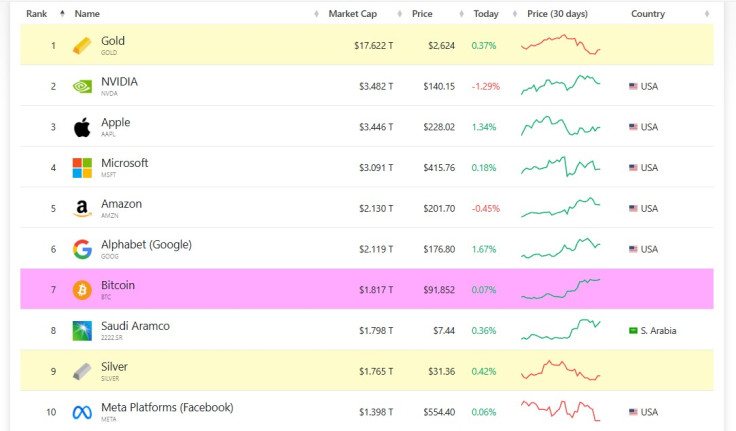

- $BTC's market cap has reached $1.817 trillion compared to Aramco's $1.798 trillion as of early Tuesday

- Bitcoin passed silver's market value last week amid optimism around Trump 2.0

- Aramco is 91 years old, whereas Bitcoin officially entered the market in 2009

Bitcoin has reached a new milestone, passing Saudi Aramco to become the world's seventh-largest asset by market capitalization. The development comes just days after the world's first decentralized cryptocurrency toppled silver's market value.

Data from CompaniesMarketCap shows that as of early Tuesday, Bitcoin's total market cap has reached $1.817 trillion, while Saudi Aramco's stands at $1.798 trillion, followed by silver, which has a total market value of $1.765 trillion.

Why Does It Matter?

Saudi Aramco, which is majority owned by the Kingdom of Saudi Arabia, is widely considered the world's largest oil producer and has also been in the ranks of the world's most profitable companies for years. It is a business veteran that has weathered many economic storms, geopolitical crises, and other internal headwinds.

Aside from its undeniable profitability, Aramco is also a 91-year-old company that's already stood the test of time and saw the coming and going of many corporate giants that ultimately lost to economic woes. Bitcoin was officially launched early in 2009.

Bitcoin's latest achievement marks a significant step in the digital currency's move toward being recognized as a superpower in the world's top assets.

Not only was it able to pass silver and Aramco, but it pushed behind Facebook parent Meta, whose place has now fallen to 10th with a market value of $1.398 trillion.

BTC is now only behind Google's parent company Alphabet ($2.119 trillion), Amazon ($2.130 trillion), Microsoft ($3.091 trillion), Apple ($3.446 trillion), NVIDIA ($3.482 trillion), and long-time top spot holder gold ($17.622 trillion).

$BTC Gains Traction After US Elections

Following news of Donald Trump's presidential victory, Bitcoin led its cryptocurrency peers to the top. BTC has surged by over 30% in the last two weeks, driven by hopes that the new administration will have a friendlier approach toward the emerging industry.

Other top digital assets also spiked, including Top 2 Ethereum (ETH), Solana (SOL), XRP, and Cardano (ADA) among others.

While the broader crypto industry truly benefited from hopes pinned upon Trump's "second coming," Bitcoin was the biggest story in the crypto space as it hit new all-time highs (up to $93,400) within days after the election.

CryptoQuant founder and CEO Ki Young Ju, a prominent crypto analyst, declared early Tuesday that "Bitcoin euphoria is here." According to Ki, the period typically lasts between three and 12 months.

Milestone after Milestone

Bitcoin's new milestone also came at a historic time in the digital coin's history. Exactly 15 years ago, its pseudonymous creator, Satoshi Nakamoto, joined the Bitcoin Forum. "The world hasn't been the same since," crypto exchange giant Binance wrote on X to celebrate the event.

Today marks 15 years since Satoshi Nakamoto joined the #Bitcoin Forum.

— Binance (@binance) November 19, 2024

And the world hasn’t been the same since! pic.twitter.com/8OdDQgFyh6

It remains to be seen when BTC will topple Google, given heightened optimism that the world's top digital currency was designed to only go higher.

© Copyright IBTimes 2024. All rights reserved.