Stock Markets Jump With Focus On US Debt, Elections

Major stock markets advanced Monday after President Joe Biden said he was "optimistic" about finding an agreement on averting a first-ever US default.

Traders reacted also to a mixed inflation picture out of Europe and weekend elections in Thailand and Turkey.

Stock markets in Europe and Asia kicked the week off with gains amid "growing hopes that the Democrats and Republicans will reach a deal to avert the disastrous scenario of a government default" in the world's biggest economy, noted Victoria Scholar, head of investment at Interactive Investor.

Elsewhere, European gas prices reached the lowest levels in almost two years as concerns about tight supplies continued to ease heading into the summer.

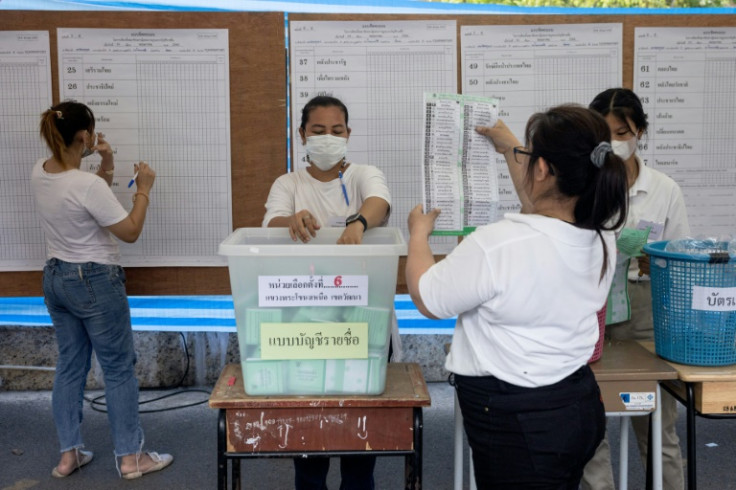

On currency markets, the Thai baht rallied as pro-democracy parties looked set to win weekend general elections, with voters delivering a clear rejection of nearly a decade of military-backed government.

The progressive Move Forward Party claimed victory Monday, while the Pheu Thai party agreed to join a coalition government.

However, stocks in Bangkok fell.

The Turkish lira edged down, reversing earlier gains, as the country looked set for a presidential election runoff.

President Recep Tayyip Erdogan will face opposition candidate Kemal Kilicdaroglu again in a second round on May 28 if neither candidate achieves the 50 percent needed to win.

"If these results hold, it would be one of the worst outcomes for the markets," said Ogeday Topcular, a money manager at RAM Capital SA.

"There will be (no clarity) for the next two weeks."

In Brussels, the European Commission boosted its 2023 economic growth outlook for the eurozone -- but also raised the inflation forecast for the single currency area.

"The European economy is in better shape than we projected last autumn," the EU commissioner for the economy, Paolo Gentiloni, said in the statement.

"Thanks to determined efforts to strengthen our energy security, a remarkably resilient labour market and easing supply constraints, we avoided a winter recession and are set for moderate growth this year and next."

Outside the eurozone, Sweden's inflation slowed more than expected in April as food prices dropped for the first time since 2021, official data showed Monday, possibly giving the country's central bank room to pause its rate-hike campaign.

London - FTSE 100: UP 0.5 percent at 7,793.06 points

Frankfurt - DAX: UP 0.3 percent at 15,957.00

Paris - CAC 40: UP 0.5 percent at 7,452.55

EURO STOXX 50: UP 0.3 percent at 4,331.55

Tokyo - Nikkei 225: UP 0.8 percent at 29,626.34 (close)

Hong Kong - Hang Seng Index: UP 1.8 percent at 19,971.13 (close)

Shanghai - Composite: UP 1.2 percent at 3,310.74 (close)

New York - Dow: FLAT at 33,300.62 (close)

Euro/dollar: UP at $1.0876 from $1.0853 on Friday

Pound/dollar: UP at $1.2506 from $1.2451

Dollar/yen: UP at 136.16 yen from 135.69 yen

Brent North Sea crude: UP 0.2 percent at $74.32 per barrel

West Texas Intermediate: UP 0.4 percent at $70.35 per barrel

© Copyright AFP 2025. All rights reserved.