US Consumer Inflation Edges Up In July

US consumer inflation inched up in July, government data showed Thursday, rebounding slightly for the first time in around a year and weighing on policymakers as they mull further interest rate hikes.

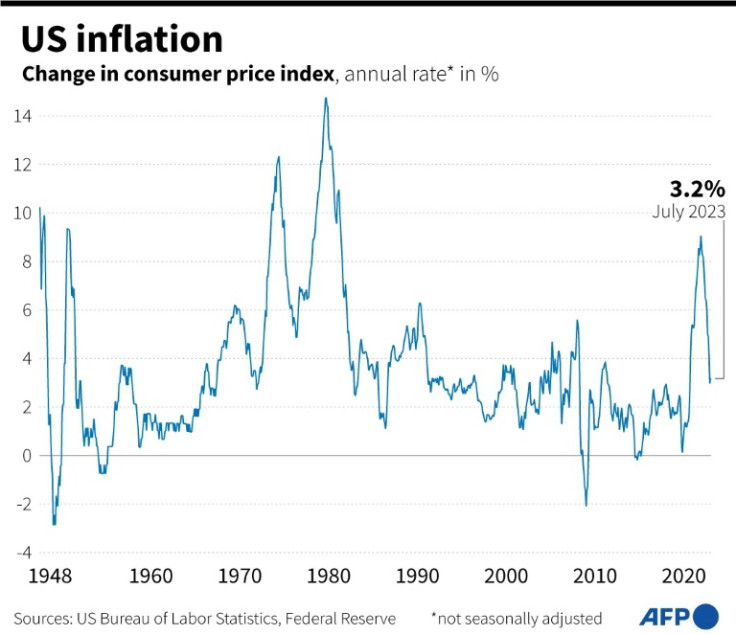

The consumer price index (CPI), a key inflation gauge, rose 3.2 percent from a year ago last month, according to the Labor Department -- slightly up from June's 3.0 percent pace and breaking a streak of cooling figures.

The latest CPI number remains moderate compared with last year's figures, as the Federal Reserve's rapid interest rate hikes bite. Last month, the Fed raised rates to the highest level since 2001.

But with the world's biggest economy showing signs of cooling, officials said they would remain data dependent when making further rate decisions -- amid growing hope that their policy moves will lower inflation while avoiding a major recession.

"Today's report shows that our economy remains strong," President Joe Biden said in a statement.

"Annual inflation has fallen by around two thirds since last summer, and inflation outside of food and energy has fallen to its lowest level in any three-month period since September 2021," he added.

The CPI held steady in July on a month-on-month basis, rising the same pace as in June, according to Labor Department data.

"The index for shelter was by far the largest contributor to the monthly all items increase, accounting for over 90 percent of the increase, with the index for motor vehicle insurance also contributing," the department said.

Energy prices ticked up just 0.1 percent from June to July, while food prices rose 0.2 percent.

Excluding the volatile food and energy segments, "core" CPI rose 4.7 percent from a year ago -- its slowest pace since October 2021.

"While inflation is still far above target, and the annual change in headline CPI picked up in July, core prices are moving in the right direction," said Rubeela Farooqi, chief US economist at High Frequency Economics.

Analysts had expected a slightly higher headline CPI reading as well, according to MarketWatch.

Farooqi added that the July figures will be "welcome news to policymakers" who have a longer-term inflation target of two percent.

"The July CPI report offered more convincing evidence that inflation pressures are abating," said EY-Parthenon senior economist Lydia Boussour.

While rent prices picked up from the previous month, "we're clearly past peak inflation on the housing front," she added.

Consumer inflation hit a high of 9.1 percent on an annual basis in June 2022, and has been cooling since then.

For now, the CPI report argues for Fed officials to hold interest rates steady at their next policy meeting in September, Boussour said.

But with inflation still far from target, officials will "likely maintain a hawkish bias and keep the door open to further rate hikes if the data justifies it," she said.

Ryan Sweet, chief US economist at Oxford Economics, believes the central bank could be done hiking interest rates.

"We expect the Fed to skip rate hikes in September and November, when inflation should have decelerated even further," he wrote in a note.

But the US central bank is unlikely to cut rates until early next year to ensure that it wins the inflation battle, said Sweet.

© Copyright AFP 2025. All rights reserved.