Stocks Diverge, Dollar Down As Biden Exits White House Race

Stock markets diverged and the dollar dropped Monday as Joe Biden's decision to drop out of the US presidential race fuelled fresh uncertainty.

Main equity indices in Tokyo, Shanghai and Sydney closed lower, though Hong Kong rallied thanks to healthy gains in Chinese tech firms.

Europe's major stock markets rose strongly, led by Paris and Frankfurt which each recorded gains of nearly 1.5 percent approaching the half-way mark.

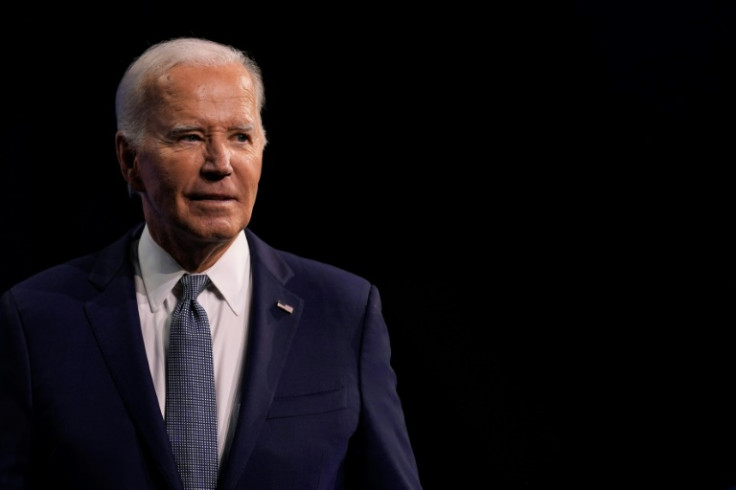

Biden on Sunday gave in to weeks of calls for him to step aside in the wake of a poor debate performance that amplified questions about his health, and endorsed Vice President Kamala Harris to succeed him.

The news has left traders wondering who will go head to head with Donald Trump in the battle to lead the world's biggest economy.

Analysts said markets would likely be volatile in the near term.

"Market instinct will be to say that the news adds a degree of uncertainty to the outcome of the 5 November election that wasn't present last week," noted National Australia Bank analyst Ray Attrill.

However, "it will be many weeks... before anyone can reasonably determine if the race for the White House is significantly narrower than looked to be case".

Stocks in Asia fell Monday following losses Friday on Wall Street and in Europe, where trade was dominated by a crash in global computer systems.

A result of a faulty update to an antivirus program, the crash hit airports, airlines, trains, banks, shops and even doctors' appointments.

In trading Monday -- which coincided with the start of Britain's Farnborough airshow -- Ryanair's share price slumped more than 13 percent.

The Irish no-frills carrier warned that despite rising passenger demand for its routes across Europe, revenue would continue to suffer from average air fares remaining lower than expected.

"While travel demand has bounced back since the pandemic, travellers are reluctant to book too far ahead," said Dan Coatsworth, investment analyst at AJ Bell.

He cited "high interest rates" and passengers "holding out for a bargain" as likely reasons for Ryanair and rival carriers needing to lower air fares in the peak summer season.

Elsewhere Monday, there was little reaction to news that China's central bank had cut borrowing costs as leaders look to kickstart the world's number two economy, which has been hammered by a huge property crisis and weak consumer demand.

The Bank of China lowered the one-year and five-year loan prime rates in a bid to encourage commercial banks to grant more credit.

London - FTSE 100: UP 0.8 percent at 8,219.24 points

Paris - CAC 40: UP 1.4 percent at 7,638.35

Frankfurt - DAX: UP 1.4 percent at 18,428.56

EURO STOXX 50: UP 1.6 percent at 4,902.21

Tokyo - Nikkei 225: DOWN 1.2 percent at 39,599.00 (close)

Hong Kong - Hang Seng Index: UP 1.3 percent at 17,635.88 (close)

Shanghai - Composite: DOWN 0.6 percent at 2,964.22 (close)

New York - Dow: DOWN 0.9 percent at 40,287.53 (close)

Euro/dollar: UP at $1.0889 from $1.0885 on Friday

Pound/dollar: UP at $1.2936 from $1.2914

Dollar/yen: DOWN at 156.80 yen from 157.47 yen

West Texas Intermediate: DOWN 0.1 percent at $80.05 per barrel

Brent North Sea Crude: DOWN 0.3 percent at $82.42 per barrel

© Copyright AFP 2025. All rights reserved.