US Bitcoin ETFs Bouncing Back? Inflows Hit $1.7 Billion In 7 Days

KEY POINTS

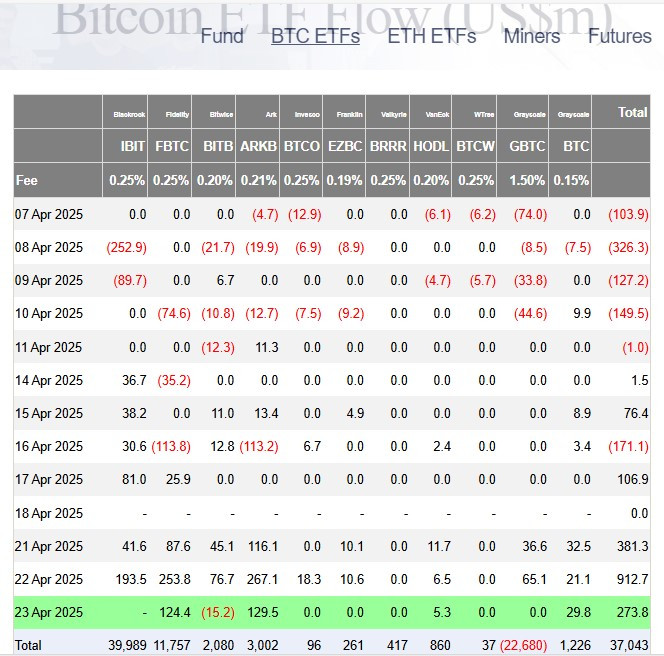

- Tuesday was the biggest day of the week for $BTC ETFs, bringing in $912.7 million

- Bitcoin surged to $93,000 this week after a plunge to $75,000 earlier this month

- Ethereum ETFs are still struggling despite Bitcoin ETFs' uptrend in recent days

Spot Bitcoin exchange-traded funds (ETFs) in the United States have been on a relatively good run in the last seven days, hauling in over $1.7 billion, led by Tuesday's massive rally of over $900 million in positive flows.

The past week's inflows are a stark contrast from earlier this month, when BTC ETFs bled dramatically amid a downturn in the broader cryptocurrency market as triggered by fears around U.S. President Donald Trump's global trade war.

Bitcoin ETFs Rally as $BTC Passes $90,000

Data from London-based asset manager Farside Investors showed that in the last seven days, spot BTC ETFs only had one day of negative flows, when the funds saw over $171 million in outflows.

However, Tuesday was a big day for the ETFs, bringing in a staggering $912.7 million, led by Ark Invest-21Shares ARKB BTC ETF which hauled in $267.1 million.

Notably, Tuesday's haul came as Bitcoin surged from below $88,000 to $93,000, bringing some much-needed relief to the community that had been waiting a few weeks for a dramatic price uptrend.

The price spike of the world's most valuable crypto asset triggered a market-wide uptick, pulling up other major altcoins, including Ethereum (ETH), XRP, and Cardano (ADA).

Earlier this month, spot Bitcoin ETFs were bleeding. At one point, the single-day outflows were at $326.3 million as BTC prices struggled to break out of an earlier plunge to $75,000.

'Pac-Man Mode' for $BTC ETFs

Senior ETF analyst for Bloomberg Eric Balchunas took to X on Wednesday to point out how spot BTC ETFs "went Pac-Man mode" Tuesday, referring to the classic arcade game Pac-Man, wherein the main character, Pac-Man is guided by a player through a maze to eat dots.

The spot bitcoin ETFs went Pac-Man mode yesterday, +$936m, $1.2b for week. Also notable is 10 of 11 of the originals all took in cash too. Good sign to see flow depth vs say $IBIT doing 90% of the lifting. Price up $93.5k. Pretty strong all things considered IMO. pic.twitter.com/HeLwffgT8F

— Eric Balchunas (@EricBalchunas) April 23, 2025

"Good sign to see flow depth vs say $IBIT doing 90% of the lifting. Price up $93.5k. Pretty strong all things considered IMO," Balchunas said.

IBIT is BlackRock's Bitcoin ETF, which remains the largest spot BTC ETF in the funds' history. Some crypto observers are also watching the other rallying funds. "Looking forward to Fidelity overtaking Grayscale," said one X user.

Ethereum ETFs Still Struggling in the Red

Meanwhile, Ethereum ETFs are still way behind the achievements of Bitcoin ETFs.

The latest data showed that in the last seven days, there were more outflow days than those that logged inflows.

On the other hand, the funds did have a two-day inflow streak on Tuesday and Wednesday, collectively snapping up over $45 million.

It remains to be seen whether ETH ETFs will someday catch up to BTC ETFs, but for now, it's safe to say Ethereum ETFs have a long way to go before they can overtake the king of crypto ETFs.

Originally published on IBTimes

© Copyright IBTimes 2025. All rights reserved.