US Consumer Inflation Accelerates For Second Straight Month In November

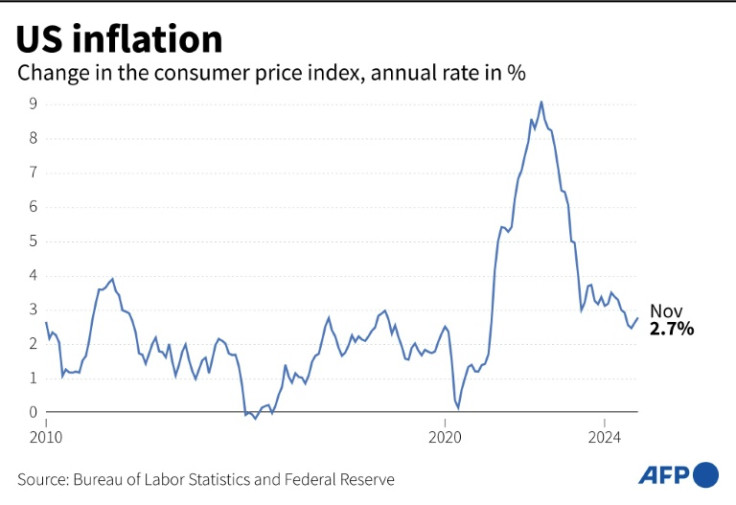

US consumer inflation ticked up for a second consecutive month in November, driven by food prices and other sectors, according to government data published Wednesday, complicating the Federal Reserve's rate cut deliberations.

The consumer price index (CPI) rose to 2.7 percent last month from a year ago, up slightly from 2.6 percent in October, the Labor Department said in a statement.

This was in line with the median forecast of economists surveyed by Dow Jones Newswires and The Wall Street Journal.

"This data really underscores what a game of Whack-A-Mole getting inflation down has been for the Federal Reserve," KPMG chief economist Diane Swonk told AFP.

The November inflation data is "just about good enough," analysts at Evercore ISI wrote in a note to clients, adding it left the Fed on track to cut rates again at its next interest rate decision on December 17 and 18.

On a monthly basis, headline inflation rose 0.3 percent, propped up by housing costs.

Several other indexes also edged higher, including food, energy, medical care and recreation, the Labor Department said.

Among the sharpest year-on-year increases was the cost of eggs, which has surged by 37.5 percent as the US has contended with avian flu.

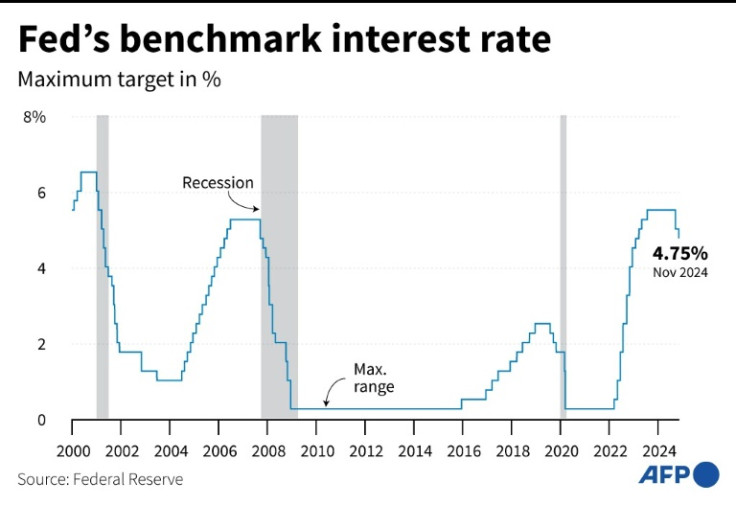

The back-to-back increases add to the challenges the Fed faces returning inflation to its long-term target of two percent, potentially slowing the pace of rate cuts over the coming months.

The Fed's favored inflation gauge, the PCE price index, which differs slightly from CPI, also rose in October, underscoring the bumpy path back to two percent.

The US central bank recently began dialing back interest rates from a two-decade high, and its benchmark lending rate currently sits at between 4.50 and 4.75 percent, down three quarters of a percentage-point from September.

The financial markets overwhelmingly expect the Fed to make another quarter point cut next week, according to CME Group data.

But some analysts expect the Fed to be more cautious about cutting than markets expect.

"I still thinks its closer than financial markets have it priced in," said Swonk from KPMG.

This will be the last Fed rate decision before President Joe Biden, a Democrat, hands over the White House to incoming Republican Donald Trump.

In a statement, Biden's top economic advisor attempted to paint the inflation data in a more positive light.

"For four months in a row now, inflation has been close to the level right before the pandemic," National Economic Council Director Lael Brainard said, adding the administration would "continue to fight to lower costs for American families."

But Republicans in Congress took a very different view, with Florida Senator Rick Scott criticizing the rise in the cost of living under Biden.

"The Biden-Harris administration will be remembered forever by families for its 20% inflation and economic failures that placed historic financial burdens on folks in every state," he said in a statement.

"It's time for a total fiscal turnaround on the national level," he added.

The US labor market has proven to be relatively resilient to high interest rates, despite some recent signs of weakness, with hiring still strong and the unemployment rate remaining low.

At the same time, economic growth has been robust, giving the Fed an excuse to pause rate cuts in the coming months to see how its fight against inflation unfolds, should it wish to.

The US consumer inflation rate slowed for much of this year, falling to 2.4 percent year-on-year in September, before reversing course in recent months.

That could pose a challenge for the incoming Trump administration, which made tackling inflation and the cost of living a top priority on the campaign trail.

A measure of inflation that strips out volatile food and energy costs known as core inflation came in at 3.3 percent in the 12 months to November, and rose by 0.3 percent from October, according to the Labor Department.

This was in line with expectations.

© Copyright AFP 2025. All rights reserved.