FTX Had 'Complete Failure' Of Controls, New CEO Says

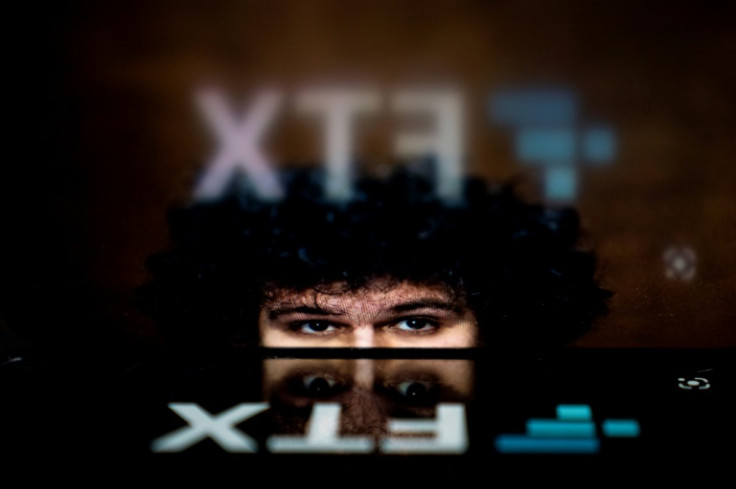

Collapsed cryptocurrency exchange FTX suffered a "complete failure of corporate controls" under founder Sam Bankman-Fried, the company's new chief executive said Thursday, calling the situation "unprecedented."

The scathing condemnation came in a filing in US bankruptcy court from John J. Ray -- an executive with 40 years of experience in corporate restructurings including the infamous implosion of Enron in 2001.

Ray lambasted the failures of oversight, incomplete records, missing and unreliable financial statements and "potentially compromised" leadership at FTX, which declared bankruptcy last week -- a stunning downfall for a firm recently valued at $32 billion.

"Never in my career have I seen such a complete failure of corporate controls and such a complete absence of trustworthy financial information as occurred here," Ray said in the filing.

"From compromised systems integrity and faulty regulatory oversight abroad, to the concentration of control in the hands of a very small group of inexperienced, unsophisticated and potentially compromised individuals, this situation is unprecedented," he said.

The downfall of FTX came amid growing doubts over its financial stability, with attention focused on the relationship between the exchange and Alameda Research, a trading house also owned by Bankman-Fried, and reports he shifted funds out of the exchange, even as he tried to fill a $7 billion financing gap.

Binance, the world's biggest cryptocurrency platform, backed out of a buyout deal that could have stemmed the fall amid reports about mismanagement of client funds and potential investigations by regulators.

US officials are now calling for more oversight of the industry, and Congress plans to hold hearings to investigate.

Ray said he has "substantial concerns" about the reliability of financial statements and related entities, and noted that there were "at least $372 million of unauthorized transfers."

Executives at the firm -- many of whom Ray said "were not aware of the shortfalls or potential commingling of digital assets" --"have located and secured only a fraction of the digital assets of the FTX Group that they hope to recover."

The implosion was a spectacular reversal of fortune for the founder and one-time cryptocurrency wunderkind Bankman-Fried.

Ray slammed the former CEO saying he "often communicated by using applications that were set to auto-delete," and making clear he no longer speaks for FTX notwithstanding his frequent public declarations.

Bankman-Fried "continues to make erratic and misleading public statements," Ray said, pointing to comments published by Vox on Thursday in which the disgraced executive said he regretted filing for bankruptcy.

"F*** regulators they make everything worse," Bankman-Fried said in a direct message on Twitter to the Vox reporter.

He later tweeted that he was "venting" and his comments were meant to remain private.

© Copyright AFP 2025. All rights reserved.