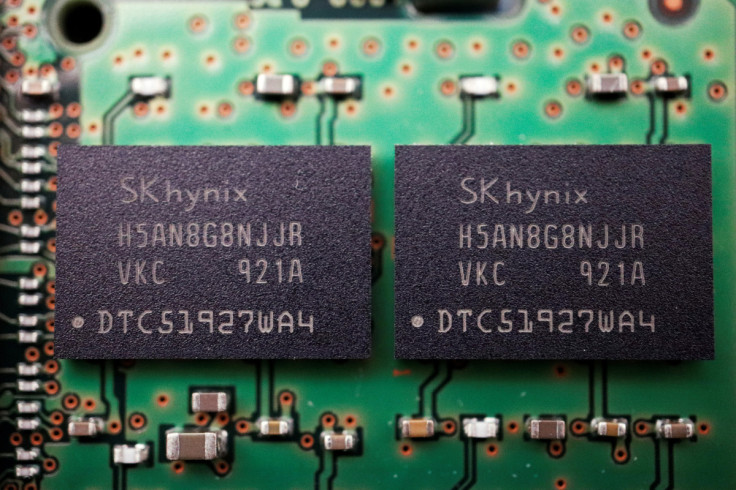

In 'Unprecedented' Global Chip Slump, SK Hynix To Halve Investment As Recession Looms

South Korea's SK Hynix Inc warned on Wednesday of an "unprecedented deterioration" in memory chip demand, deepening fears of global recession, and said it would slash investment after quarterly profit tumbled 60%.

The world's second-largest memory chipmaker, whose clients include Apple Inc, said its investment in 2023 will be cut by more than 50% - an echo of cuts the memory chip industry endured in the 2008-09 financial crisis that provides a stark portrait of the depth of a worldwide slowdown in tech demand.

Chipmakers had enjoyed a strong post-pandemic demand surge until early this year. But demand has turned sharply weaker in recent months as soaring inflation, rising interest rates and gloomy economic outlook have led consumers and businesses to tighten spending.

"We are hoping that the market will stabilise to some extent by second half of next year, but we are not ruling out the possibility of a longer downturn," Kevin Noh, Chief Marketing Officer at SK Hynix, told analysts.

Investors looked beyond the bleak outlook to welcome the aggressive investment cut, sending SK Hynix shares 1.7% higher in a bet the scale of the action would help control chip oversupply and prop up chip prices.

SK Hynix's dire projections add to a flurry of warnings from U.S. tech giants this week of faltering growth prospects. Microsoft Corp on Tuesday projected quarterly revenue below Wall Street targets across its business units, including its cloud business and PC unit.

SK Hynix said its operating profit fell to 1.66 trillion won ($1.16 billion) in the July-September quarter, from 4.2 trillion won a year earlier. The result was below analysts' expectations of a 1.87 trillion won profit, according to Refinitiv SmartEstimate.

"Supply will continue to exceed demand for the time being," SK Hynix said in a statement, pointing to a fall in notebook and smartphone shipments.

Memory chip prices plunged by 20% as demand fell across all applications in the third quarter, SK Hynix said, citing dropping PC and smartphone shipments while data centres prioritised using up existing chip inventory.

NO TURNAROUND TILL LATE 2023?

SK Hynix said its 2022 investment is expected to be at the "upper range of 10-20 trillion won ($7-14 billion)", meaning 2023 investments could fall below 10 trillion won.

"The capex cut was bigger than I expected," said Wi Minbok, analyst at Daishin Securities.

"Even if SK Hynix reduces investments, it will take around six months until actual output is affected ... We don't anticipate market conditions to turn around before the third quarter of 2023."

Other chipmakers have also begun curtailing supply and investment. U.S. firm Micron Technology plans to cut investments by more than 30% next year, while Taiwanese giant TSMC has also cut its 2022 investment plan.

The spending cuts come as the global smartphone market, a key revenue source for the chip industry, contracted 9% on-year in July-September, marking the worst third-quarter since 2014, according to analysis provider Canalys.

SK Hynix also warned of uncertainties involving its chip plants in China due to U.S. export restrictions on advanced chip equipment to China aimed at slowing Beijing's technological advances.

The company received a one-year waiver on the restrictions for its chip plants in China, but said it would be difficult to operate its Wuxi plant in the country if the waiver was not extended, and may have to consider selling the plant or bringing equipment to South Korea.

($1 = 1,426.6500 won)

© Copyright Thomson Reuters 2025. All rights reserved.